VAT – what is disaggregation (artificial separation) of a business?

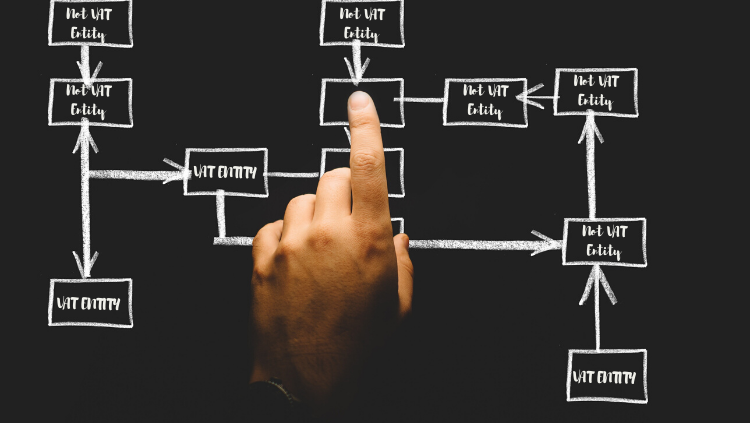

Disaggregation is when business owners seek to avoid charging VAT by splitting their business into different parts to ensure each operates under the VAT registration threshold. For a limited company, some business owners may look to establish separate companies. A sole trader may seek to establish separate trades.

There can be compelling reasons for splitting a business, but you need to tread carefully as HMRC rules are set against any disaggregation or artificial separation of a business.

Disaggregation, VAT and HMRC

By setting up two businesses, business owners believe they can allocate their revenue across different businesses to ensure they do not exceed the VAT registration threshold (in 2018/19 the threshold is £85,000 for an individual business). If the threshold is not exceeded, businesses don’t need to register for VAT and may have a competitive advantage.

HMRC believes this practice qualifies as tax avoidance and has set specific rules designed to ensure only legitimate ‘business splitting’ occurs. This means you must prove there is no ‘financial, economic or organisational’ link between your businesses. If you can’t provide strong evidence there are no such links, HMRC can impose penalties and/or prosecute you. Examples of the links HMRC look for when deciding whether businesses are related or not are shown below:

Financial

- Businesses have the same bank account

- A common business profit or financial interest that benefits both businesses

- Financial dependency on one another.

Economic

- Sharing equipment

- Operating from the same offices

- Sharing advertisements.

Organisational

- Common employees and/or managers.

There may be legitimate reasons for splitting your business, and there can be positive indicators to HMRC that this is the case if your businesses operate with the following characteristics:

- Separation of bank accounts and business records

- Each business is separately registered with HMRC and submit their own tax returns.

Customers should be convinced that they are dealing with two businesses Any charges for goods and services between the split businesses must be conducted at arm’s length.

Maybe it’s time to switch?

If you have any questions or concerns about your own business and whether disaggregation rules could apply, it’s best to speak with an accountant for specific advice. HMRC rules are applied on a case-by-case basis and you must plan carefully to avoid falling foul of these rules.

If your accountant is the one to suggest disaggregation, maybe it’s time to consider switching. Contact us today for a free consultation and discover how the chartered accountants at Accounting Wise can help you.